Dealing with HS codes in Malaysia can sometimes feel like cracking a tough puzzle, especially when you’re pressed for time or unsure of the right classification. Whether you’re new to importing or exporting or have years of experience, getting the Malaysia HS Code wrong can lead to serious problems—delays at customs, unexpected fines, or even legal issues. But don’t worry! We’ve got your back.

Introducing: Malaysia HS Code Advisor

Finding the correct HS code doesn’t have to be stressful. With our AI-powered Malaysia HS Code Advisor, you can quickly identify the correct HS code for your products and even get advice on accurate classification. This tool not only saves you time but also reduces the risk of errors that could cost you later.

And that’s not all! If you’re still feeling unsure or stuck, our friendly customer service team is just a WhatsApp message away. Got a tricky product or an uncommon item? Just reach out, and we’ll assist you step-by-step.

Why Is Getting the Right HS Code So Important?

In Malaysia, HS codes (Harmonized System codes) are a crucial part of every customs declaration. They’re used to classify your products for import/export duties, tax calculations, and compliance with customs regulations. But here’s the catch:

- Wrong Code = Big Problems

- If your HS code is incorrect, your shipment could get flagged by customs, leading to long delays. Worse, you might face fines or penalties for misclassification.

- Confusing Rules

- With thousands of codes to choose from, it’s easy to make a mistake, especially if you’re dealing with unique or borderline items. Some categories have tricky distinctions, and even experienced traders get it wrong sometimes.

- Inconsistent Information

- Many Malaysian businesses struggle with finding reliable guidance for HS codes. Googling doesn’t always give you clear answers, and interpreting customs regulations on your own can feel like a nightmare.

What If You Can’t Find the Right HS Code?

If you can’t find the correct HS code, your shipment might be held up indefinitely. Customs officers might classify your product for you—but this often results in higher taxes or duties than necessary. Worse, repeated mistakes can damage your reputation and create unnecessary hassle for your business.

In Malaysia, the lack of clear instructions can make this process especially tough. Many businesses spend hours (or even days) just trying to match their products to the right HS code. And let’s be honest, who has time for that?

How Our Malaysia HS Code Advisor Can Help

Here’s how we make it simple:

- Fast Results: Our AI tool provides quick suggestions for your product’s HS code, saving you hours of manual research.

- Affordable Pricing: For just RM9 ($2), you can access this helpful tool to make your customs process easier and more efficient.

- Close Match Suggestions: While we cannot guarantee 100% accuracy, our tool helps you choose the closest HS code based on your product description.

- Expert Support: Still unsure or facing problems? Just WhatsApp our customer service team, and we’ll work with you to find the right solution.

For Example, Here’s How Our GPT Works

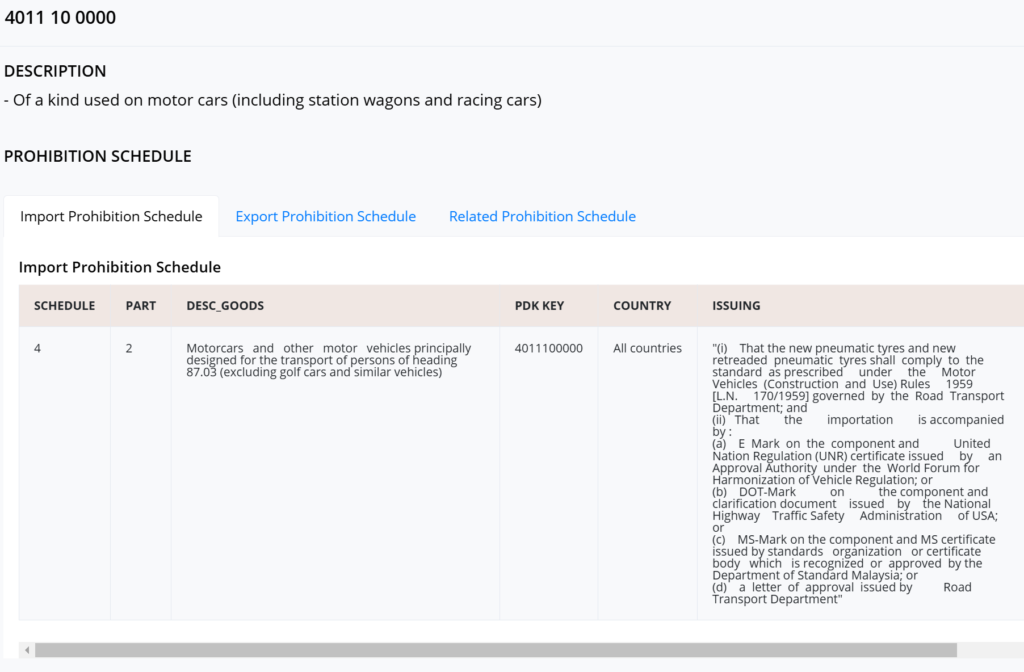

Let’s say you want to export “Car Tyres”

- Simply describe your product in our tool:

- The GPT will suggest a close HS code.

- If you’re still unsure, WhatsApp us with more details, and we’ll help confirm if this code is the best fit or suggest alternatives.

Stop Wasting Time – Get the Closest HS Code Today!

Save yourself the hassle and let us handle the tough part. With our Malaysia HS Code Advisor, you’ll have access to reliable suggestions and direct support to help ensure smooth customs clearance.

Ready to simplify your import/export process? Try our HS Code Advisor now for just RM9 ($2), or WhatsApp our team for expert assistance!